Innovation Investments Business Model

1. Investment Platform (planned profit)2. Electronic Investment Bank (planned profit)

3. Social and Business Network (planned profit)

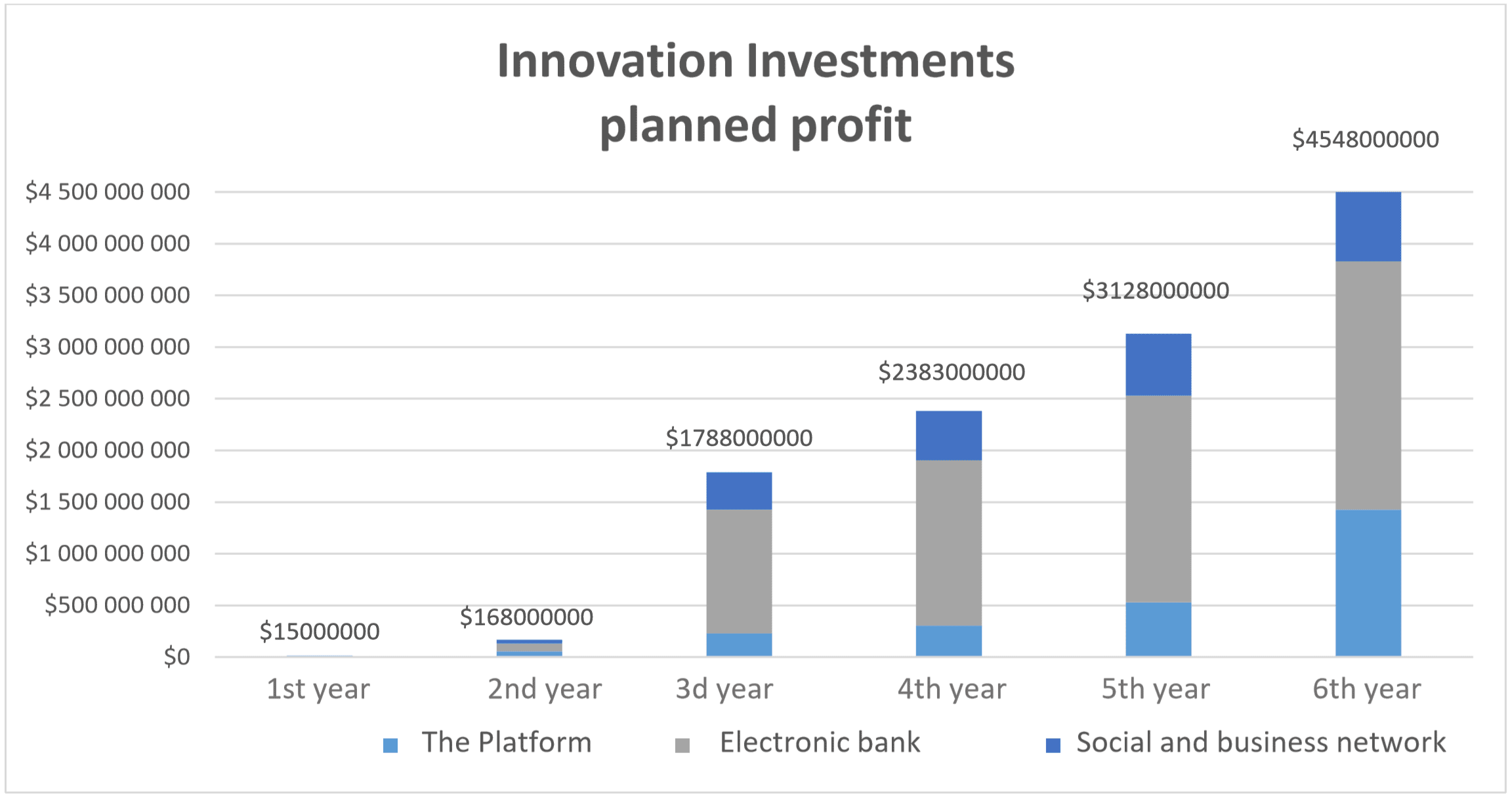

4. The total planned profitability of the Innovation Investments

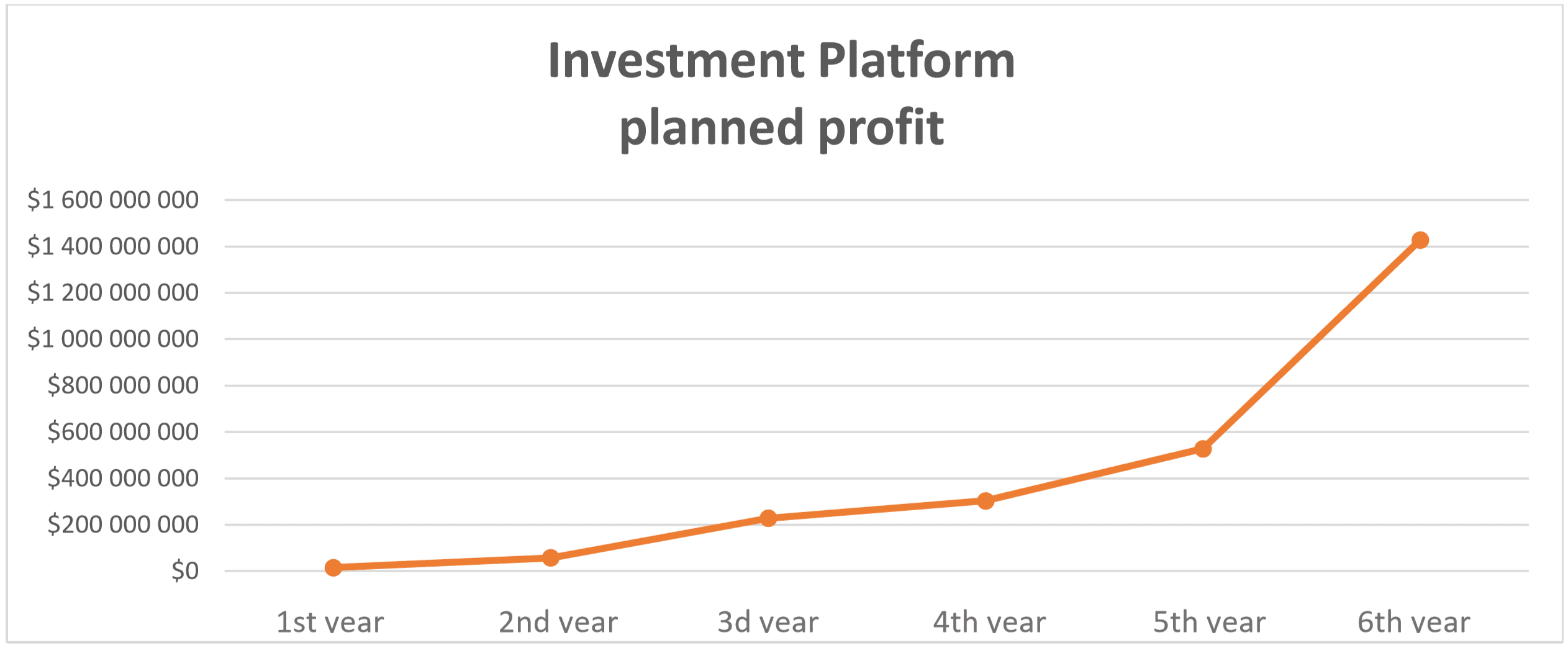

1. Investment Platform (planned profit)

When ICO is launched, the required amount of funds is planned to be USD 10,000,000 for project. The planned market value of the project in 3 years after launch > USD 50,000,000, which is equivalent to a net annual profit of USD 3 000 000 or more. In this case, the sale of the Platform share in each project will exceed USD 5 000 000 (the Platform will receive at least 10% (up to 20%) share in each investment project).

The ICO plan for the second year of the Platform's activities is 60 projects (own financing if meet the collection rate from 15 projects of the first year, fundraising from first year => USD 150,000,000).

The ICO plan for the third year of the Platform's activities is 240 projects (own funding if meet the collection rate from 60 projects of the second year, fundraising from second year => 600,000,000 USD).

The fourth year will be the first year of planned profit, which will include shares sold in the first 15 ICO - $ 75,000,000 standard and the difference between funds raised from 240 ICO and the norm for the implementation of the next 240 ICO - 303,000,000 USD.

As for the fifth year, the difference between the funds raised from the 240 ICO and the norm for the implementation of the next 240 ICO will be statistically brought to 228,000,000 USD and the 60 ICO sold shares for the second year - USD 528,000,000.

The sixth year will bring the normative 228,000,000 USD difference between funds raised from 240 ICO and the norm for the implementation of the next 240 ICOs and sold shares of 240 ICO for the third year - normatively 1,200,000,000 USD. The sixth year may be considered as a stable market niche of the Platform. With the rate of return on investments at 6%, the value of the Platform for the 6th year will exceed 24,000,000,000 USD.

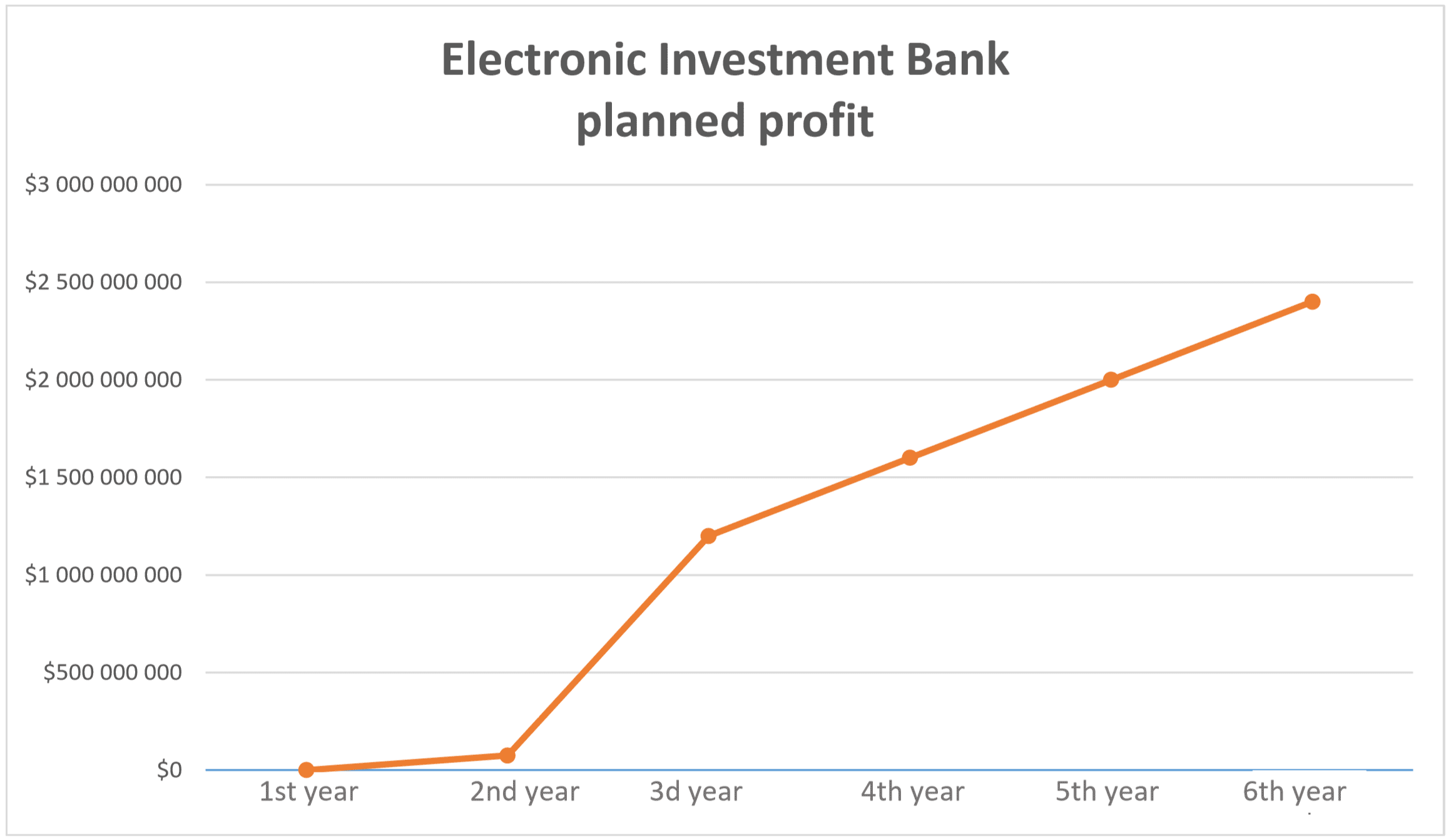

2. Electronic Investment Bank (planned profit)

Normatively, this direction will reach profitability in the second year of operation. Expected volume of money movement for the second year (turnover of "IIT") will reach 15,000,000,000 USD or about 75,000,000 USD of profit.

The third year`s Indicators - about 200 000 000 000 USD for the turnover and 1 200 000 000 USD of profit - with normative 5 000 000 USD for users.

The sixth year can be considered as a stable market niche platform.

With a return on investment at 6% per annum, the value of the e-bank of the platform for the 6th year will exceed 40 billion USD - with normative 10,000,000 for users. Excluding the profit from various financial transactions, it is expected to double-triple the preliminary figures. There is no analogue in the world!

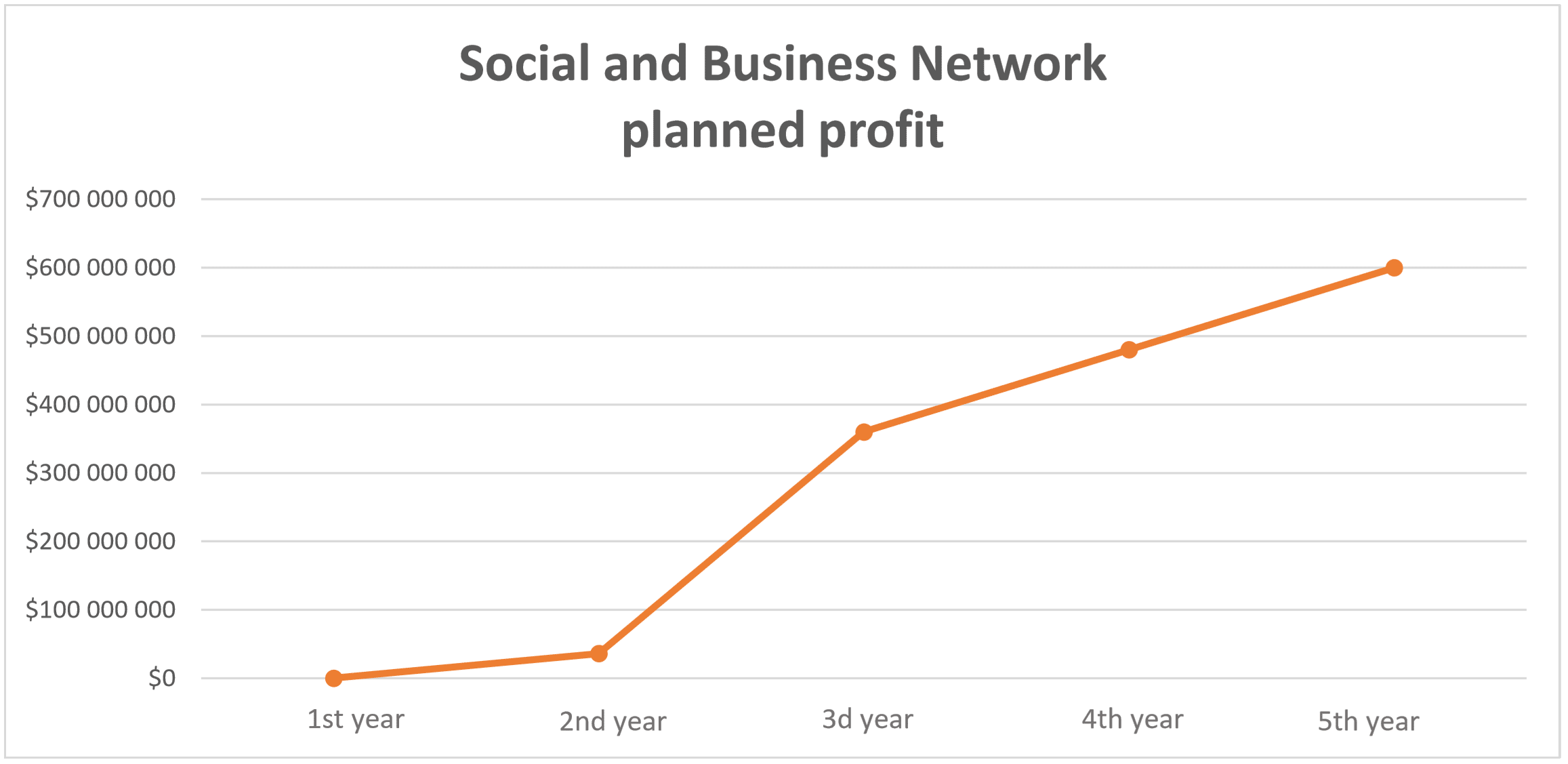

3. Social and Business Network (planned profit)

The planned involvement of active users in the platform services during the first year of operation is 50,000, an increase in users expected during the 2nd year of operation – up to 500,000, and an increase in users expected during the 2nd year of operation – up to 5,000,000. The number of active users for the 4th, 5th and 6th year will grow to 10 000 000 minimum.

During the first year all users will receive a VIP-status, which allows to exclude the display of ads on side banners and in applications, as well as other status privileges. Next, a monthly VIP-status fee will be established at 1 USD. An analogue of incomes for getting a VIP-status will be payment for advertising from external companies, which will be shown to free users.

The possibility for users to make profit from Internet sales (normatively from 3 000 USD per year for an active user) due to participation in the surcharge (charged for site development and insurance) will amount to more than 360 000 000 USD for the third year of operation and will exceed 720 000 000 USD for the sixth year of functioning.

The sixth year can be considered as a stable market niche of this direction of the company's business. The cost of the social and business part of the company will exceed 12 billion USD by the results of the 6th year at the rate of return on investment at 6% per annum. Excluding the profits from various applications, it is expected to double or triple the preliminary figures.

4. The total planned profitability of the Innovation Investments